One of our main goals for 2022 is to integrate with as many third-party providers as possible, in a bid to reduce merchant workload and ensure smooth business operation.

As our first candidate, we thought of Xero.

Xero is one of the most popular bookkeeping software to date, and considering the amount of work one needs to put in to keep updated accounting, it was the obvious pick.

How it works

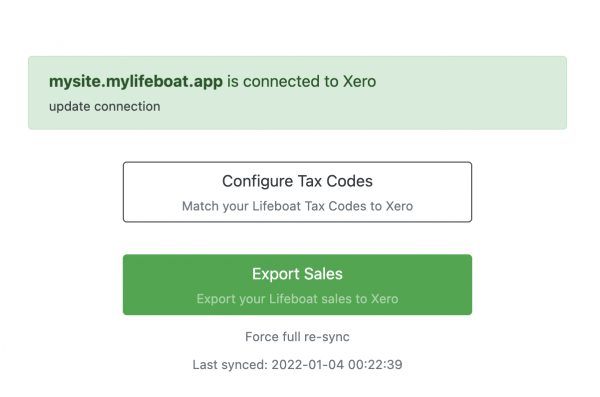

- Access: https://xero.lifeboat.app

- Go through the authentication process

- Configure Tax Codes

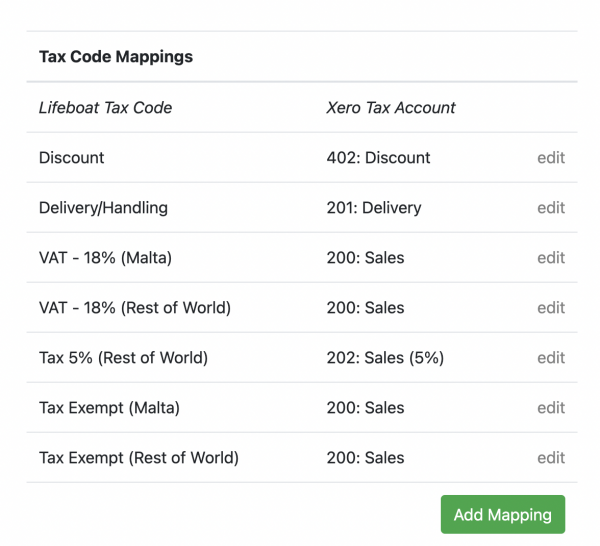

- Click on Configure Tax Codes

- Click on Add Mapping

- Select the Lifeboat Tax Code

- Select the Xero Tax Code (chart of accounts)

- Click Save

- Click Back

- Repeat the process until you have covered all your Lifeboat Tax Codes

- Run your first Sync

- Go back to the main page https://xero.lifeboat.app

- Click Export Sales

Note: The first time you run this, it may take a few minutes to sync all your orders

- Confirming the data in Xero

- Log in to xero.com

- Go to Business > Invoices

- You should see all your orders as DRAFT invoices

Troubleshooting

1. What to do if the invoices are not being imported?

If you have a very big backlog of orders that need to be imported, the process might fail. Try to;

Run a full re-sync

- Go to https://xero.lifeboat.app

- Click on Force full re-sync

2. Line Items have incorrect Tax Rate

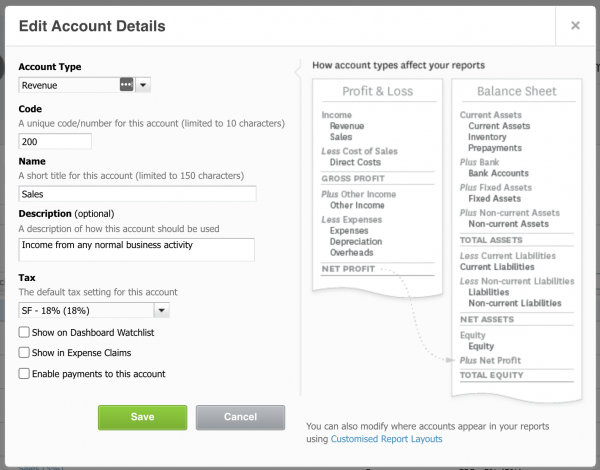

This app relies on the information in Xero to work out the tax rates so ensure your chart of accounts is properly configured.

The accounts mapped should have a default tax setting.

Other issues

If you run into any other issues don't hesitate to contact our support team. We'll be more than happy to look into the problem and help you resolve it as soon as possible.